Board Members, Friends Hold Key to Changing Lives

Last week, Mercy Home hosted our Board Member Appreciation & Open House, bringing together our dedicated board members and new...

February 26, 2026

August 5, 2025

A good portion of Mercy Home’s educational programming is aimed at helping young people develop a plan for their careers so that they can build long-term independence and success. Seminars, workshops, internships, and after-school jobs are a few of the go-to items in our toolkit that awaken kids to professional possibilities and workplace realities.

But we also understand that bringing home a paycheck is just part of attaining success and stability. Young people also need to master the basics of money management in order to create the lives they envision for themselves and their families.

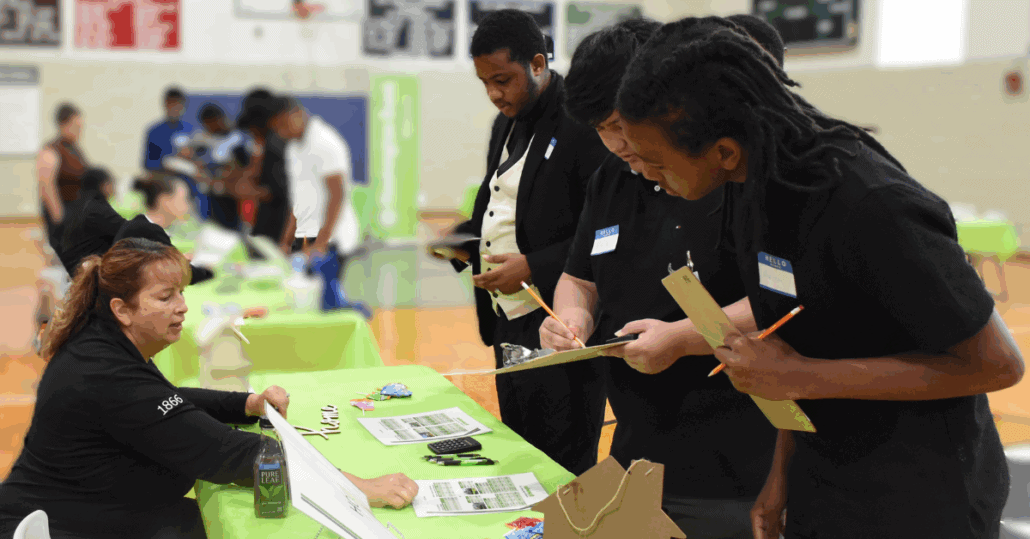

To help them get started in planning their financial futures, we turned to our friends at Huntington Bank. Huntington employees hosted two workshops this year for our young people as part of the bank’s Reality Day program. The interactive curriculum introduces students to financial decision making through career exploration, financial education, and hands-on experience making monthly budgeting decisions.

“The goal is to prepare people heading out into adulthood on how to handle basic financial needs,” said Renee Stetz, a senior regional banking relationship manager at Huntington Bank. “We want to teach them about checking accounts, how to save, and how to budget. The best thing we can do as a bank is to get young people ready to move forward instead of getting out into the world and not knowing what to do.”

The goal is to prepare people heading out into adulthood on how to handle basic financial needs.

Renee Stetz, Senior Regional Banking Relationship Manager at Huntington Bank

The first workshop at Mercy Home was held last spring. In Huntington’s most recent visit this summer, employees walked participants through steps in building a budget, stressed the importance of keeping track of spending, taught them how to identify their expenses, and explained the difference between fixed and variable expenses.

“We are laying the foundation stones for them to develop good financial habits and good spending habits,” said Gabe Avalos, Senior Coordinator, Post-Secondary Education & Career Resources.

In the workshop, youth learned about the role of checking and savings accounts in paying bills, purchasing goods, and managing income. In addition, they learned about credit, including the significance of credit scores and how missing or making a late payment can impact one’s rating. The Huntington Bank team stressed the importance of making payments on time, to prevent their credit scores from declining.

The session showed participants that a paycheck is just part of what you earn through a job. Many of our people have career aspirations and financial goals but aren’t yet familiar with the numerous other perks and incentives that they can receive. The workshop exposed them to the different benefits offered at companies and businesses, such as health insurance, retirement accounts, paid vacation, life insurance, tuition reimbursement, and more.

Our young people also had the opportunity to analyze the information found in a pay stub and explore how it factors into creating a budget using the SMART goals method.

After the presentation, our young people worked through various real-life financial scenarios, making spending and saving decisions based on assigned occupations, incomes, family members, and lifestyles. The Huntington Bank team was there to guide them, talk through strategy, and help them make sound choices.

Nathan, a Mercy Home youth, said he gained a new understanding of critical financial concepts.

“This was a fun and inspirational event,” he said. “It taught us financial literacy, credit and debit, how to be [financially] independent, and how to do banking, [which are important] things young adults need in life, so they can strive for success.”

Nathan was surprised to learn about the cost of childcare. But the hardest decision he had to make was saving the money he needed for an emergency fund, instead of purchasing items he merely wanted.

“[In the activity], I was really eager to spend money on luxurious things,” he said. “But what I had to think about was how much money I’m going to have left over if things get hard, if I lose a job and if I can’t pay rent, when I don’t have that constant income.”

It taught us financial literacy, credit and debit, how to be [financially] independent, and how to do banking, [which are important] things young adults need in life, so they can strive for success.

Nathan, Mercy Home youth

After the activity Nathan realized the importance of making sure there’s enough money in his savings account, in case he needs it something happens.

“When I have a job, [I will make sure to] always have a decent amount of savings [in case] I lose a job or become unemployed,” Nathan said. “[That way], I can still live comfortable for a couple months until I’m able to find employment.”

Scott Schutte, Senior Vice President- Regional Banking Senior Market Director at Huntington Bank was proud of our young people’s engagement throughout the whole presentation and activity.

“The kids were awesome; this was a very engaging group,” Schutte said. “We talked about budgeting, how to handle their money, and that was really impactful because you can tell it made them really start to think, ‘if I have money here, and I make this decision here, what do I have to do, how does it impact me, and how do I have to change my spending habits.’”

Avalos and Nathan expressed their gratitude to Huntington Bank for coming to the Home and giving our young people the necessary tools and knowledge to develop effective financial habits.

“It’s great to bring our partners at Huntington Bank who give us an opportunity to hear from people in their profession,” Avalos said. “Thank you to our great friends at Huntington Bank. We appreciate you all.”

Nathan agreed. “Thank you, Huntington Bank, for teaching us so much and thank you for your time, and supporting Mercy Home,” he said. You can watch this video to learn more about our young people’s experience at the Reality Days workshop held at Mercy Home this summer.

Watch this video to see our young people explore personal finance with Huntington Bank employees.

Last week, Mercy Home hosted our Board Member Appreciation & Open House, bringing together our dedicated board members and new...

February 26, 2026

The young people at our girls home enjoyed a Black History Month career panel organized by our Youth Advisory Board....

February 23, 2026

Mercy Home’s Walsh Campus for Girls continued a Valentine’s Day tradition by holding its third annual Bingo Night. Our young...

February 23, 2026

Comments