Child Abuse Statistics and Neglect Facts

Statistics on Child Abuse and Neglect Child maltreatment remains a pervasive and serious problem in the U.S. According to the...

February 11, 2026

October 9, 2025

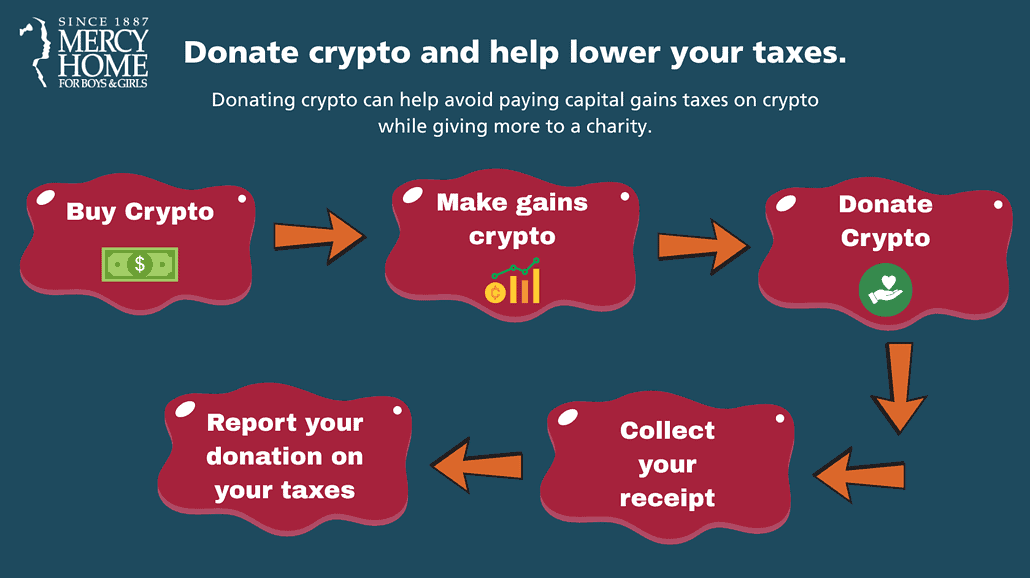

In 2025, cryptocurrency has soared to new heights, and understanding the taxes on crypto gains is essential. Profits from digital asset investments are taxable, often creating complexities. However, strategic approaches – like donating crypto assets directly to charity – may provide tax benefits to the donor while aiding the work of their favorite charities. This short guide explores crucial concepts related to crypto capital gains tax, including tax obligations, rates, and the advantages of donating cryptocurrency.

Crypto gains are profits from trading or selling cryptocurrencies, which are subject to taxes like any other security asset. If a cryptocurrency is sold above its purchase price, the difference is a capital gain, meaning profits incur crypto capital gains tax.

To calculate crypto gains, assess the difference between the selling price and the cost basis (purchase price). For instance, buying Bitcoin at $5,000 and selling it for $10,000 yields a gain of $5,000. Keeping accurate transaction records, including dates, amounts, and values at purchase and sale, is crucial for tax compliance.

Taxable events include selling crypto, exchanging one crypto for another, or using crypto for purchases. Understanding these events is key to managing investments and meeting tax obligations, including the crypto capital gains tax.

Individuals buying, selling, or trading cryptocurrency must report crypto gains or losses on their tax returns, including those receiving crypto as payment.

Neglecting to report taxes on crypto gains can lead to severe penalties, including audits, interest, fines, and legal action from The IRS. Thus, maintaining accurate transaction records is essential for compliance with capital gains tax on crypto. Consulting a tax professional can clarify reporting requirements based on individual circumstances and obligations regarding crypto capital gains tax.

Just like with traditional stocks, bonds, and other securities, the capital gains tax on crypto depends on whether the asset was bought and sold in the short-term or long-term.

Short term capital gains tax crypto applies to crypto assets held for one year or less, taxed at ordinary income rates (the same income tax rate you pay for salary, wages, or tips).

Long term capital gains tax crypto applies to crypto assets held over a year, typically taxed at lower rates of 15% or 20%, depending on taxable income.

Income tax implications can vary based on how gains are realized. Tax brackets are crucial for determining capital gains tax; higher income levels can push individuals into higher brackets, affecting the tax rate on gains.

Seeking guidance from a tax professional can assist in navigating these complexities, especially concerning short term capital gains tax crypto.

Use Crypto Tax Software: Crypto tax calculators save time and guesswork by importing your crypto transactions into software that calculates gains and income from crypto. (Tools like Koinly even allow you to tag crypto donations, so you can easily identify the amounts to declare as tax deductions.)

Navigating crypto tax complexities can be challenging, especially for newcomers. Imagine you heard about crypto and decided to purchase Bitcoin, Ethereum, or Solana, and now it’s gained 100% or more in value. If you’re ready to sell it and enjoy your gains, you’re bound to owe those capital gains tax on crypto, which could be short term capital gains tax crypto or long term capital gains tax crypto.

One effective method to manage tax liabilities while contributing positively is through crypto donations to a qualified charity.

Donating cryptocurrency to charity allows you to avoid taxes on crypto gains, save money, and increase your impact on the causes you believe in. This is accomplished in three ways:

Is a gift of crypto right for you? Estimate your potential savings. Our trusted partner, The Giving Block, has a great tool to help. Try their Crypto Donation Tax Savings Calculator Tool to see how you can maximize your taxes on crypto gains.

Have unanswered questions? Let our knowledgeable philanthropy team help out!

More information for financial professionals.

Philanthropic information presented herein is intended for friends and supporters of Mercy Home for Boys & Girls. This material may be helpful in your tax and financial planning, and is based on current laws and recent court decisions. You should consult your own legal, tax, or financial planner to determine how these gift vehicles may apply to your own situation.

Statistics on Child Abuse and Neglect Child maltreatment remains a pervasive and serious problem in the U.S. According to the...

February 11, 2026

Welcome to the future of charitable giving! Donate crypto and you can support organizations that are dedicated to helping those...

September 17, 2025

Mercy Home for Boys & Girls offers a variety of mental health resources to support the wellbeing of our young...

April 22, 2025

Comments